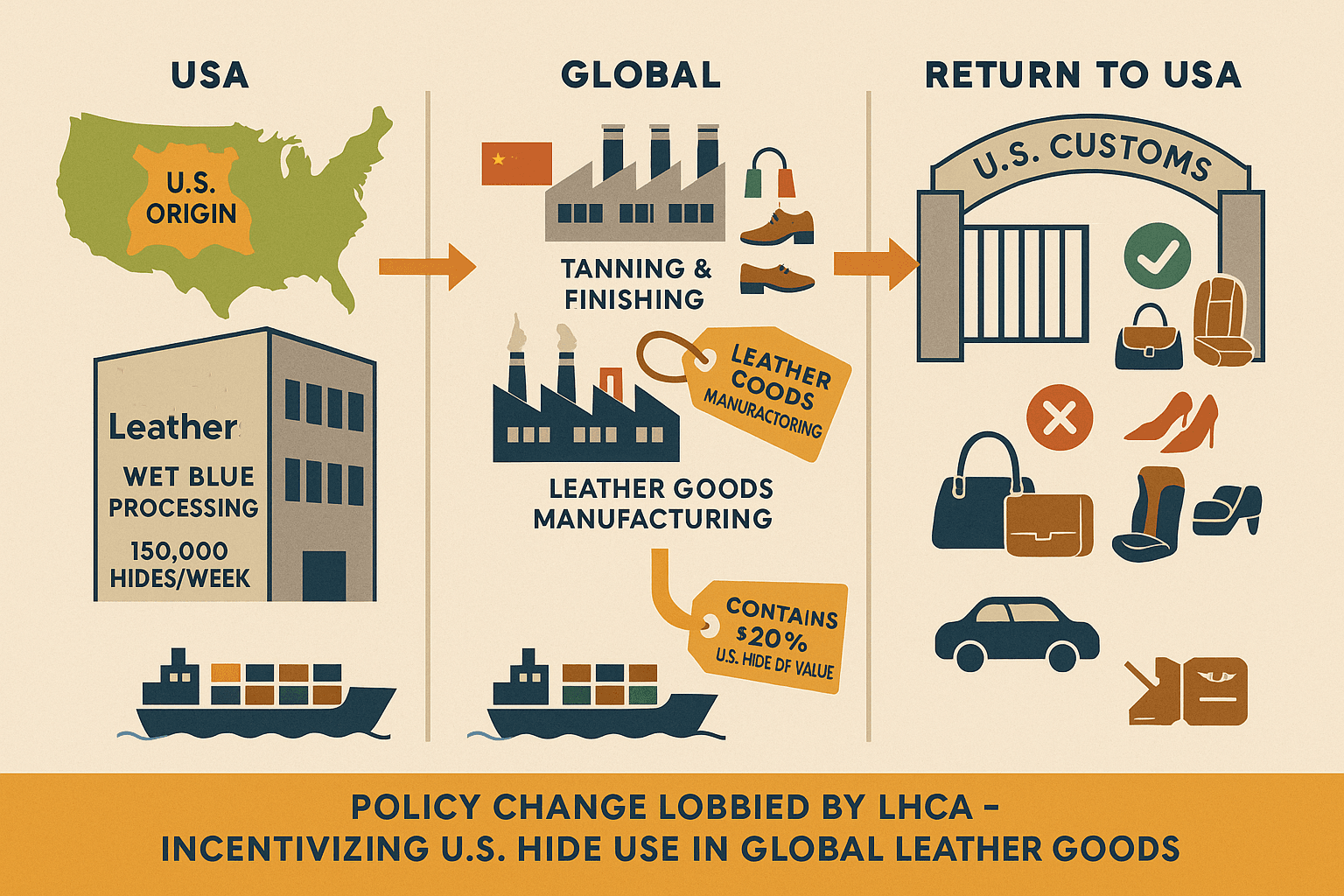

Global Leather Supply Chain and Tariffs

The leather industry operates in a highly globalised market where raw materials, semi-finished products (like wet blue leather), and finished goods are often shipped across borders for various stages of processing. In the case of U.S. leather companies, many of the raw materials (such as hides and skins) are sourced domestically, but a significant portion of these are sent overseas for processing, particularly in countries with large leather industries like China, India, and Italy.

Large volume wet blue processors in the U.S can turnaround 150,000 hides a week, and this is a good example of how U.S. companies are involved in the global leather supply chain. Wet blue leather is typically further processed in other countries to create finished leather goods. These goods are then often sold back to the U.S. market.

How the Tariff Exemption Could Affect This Process

The new U.S. tariff exemption, which applies to leather goods with over 20% U.S. hides or skins by value, could impact this scenario in several ways:

- Impact on Finished Leather Goods Returning to the U.S.:

- Tariff Exemption Criteria: The key to the tariff exemption is the value of the U.S. hides or skins in the finished product. If a leather good contains more than 20% of U.S.-sourced hides by value, it qualifies for the tariff exemption. This means that leather goods made from wet blue processed overseas (which likely contain significant U.S. hides in their composition) could be eligible for lower tariffs, potentially making them more competitive in the U.S. market.

- Wet Blue Leather and Value-Added Processing:

- Export and Reimport Dynamics: If U.S. companies are sending large quantities of wet blue overseas, it is likely that these hides are being processed into high value finished leather products abroad. The finished leather goods could then be reimported into the U.S. under the tariff exemption, provided that at least 20% of the value of the final product comes from the original U.S. hides. This creates a scenario where U.S. hides contribute to the final goods, even though the majority of the processing happens outside the U.S.

- Realistic Scenario:

- Viability of Exemption for Reimported Goods: The likelihood of this exemption having an impact depends on the ability of manufacturers to track the value-added processes and document the contribution of U.S. hides in the final goods. If leather goods produced from U.S. wet blue hides, processed overseas, meet the 20% U.S. hides by value threshold, they could benefit from this exemption when reimported into the U.S. market.

- Challenges in Documentation: One of the challenges with this scenario is the documentation and verification required to prove the U.S. content in the final leather product. Given the complex nature of global supply chains, ensuring that U.S. hides are properly accounted for in the final product may require extra effort from manufacturers, potentially involving additional audits and supply chain transparency measures.

Broader Impact on U.S. Leather Producers

- The exemption could encourage more U.S.-sourced hides to be incorporated into the final products that are reimported into the U.S., potentially boosting domestic leather production in the long term.

- However, if the majority of the tanning and finishing processes continue to take place overseas, the overall impact on U.S. domestic tanneries and leather manufacturers might be limited unless there is a shift toward more local processing.

- The exemption could provide a temporary competitive edge to U.S. producers using imported leather goods, but it might not necessarily reverse the trend of offshoring leather processing unless further incentives are created to bring more of the value-added processing back to the U.S.

Conclusion

This scenario – where U.S. wet blue leather is processed overseas and reimported as finished leather goods – is realistic, and the new tariff exemption could help make this process more cost-effective for U.S. companies involved in the leather trade. However, its success will depend on the ability to prove the U.S. content in finished goods, as well as the broader dynamics of the global leather industry. This could be a short-term advantage for U.S. producers, but long-term effects will likely hinge on broader policy shifts that incentivise more domestic processing and manufacturing.

Post Comment